Giving Women a Seat at the (Cap) Table

I have been all sides of the cap table during my career: an underpaid employee hoping for future upside, a hopeful investor supporting a founder’s vision, and an optimistic founder inviting investors to be part of mine.

The one thing that has stood out to me is that there aren’t enough women on cap tables.

Gender equity in our industry is more than just women holding a stake in a promising startup. It's about wealth distribution, economic empowerment, and shaping a more inclusive future.

The ten wealthiest Americans (all men) built their fortunes through entrepreneurship. It’s the American dream. And I firmly believe that enabling more women to get their fair space on cap tables is an essential step toward a more balanced and prosperous entrepreneurship ecosystem.

What is a cap table anyway?

In startups, wealth is created through equity, or ownership of a (hopefully) fast-growing company. A cap table, short for "capitalization table," is the name for the document that provides a detailed overview of a company's equity capitalization. It outlines the ownership stakes of all the company's shareholders, including founders, investors, and employees.

The cap table lists all the securities the company has issued, such as common and preferred stock, options, warrants, etc., and shows who owns them. The table includes details about each security, such as the issue date, purchase price, and the number of shares. In essence, it provides a snapshot of who owns what in the company.

When you hear someone say, “I’m on the cap table,” it’s just another way of saying you are one of the owners of the company.

The underrepresentation of women on cap tables

Whether we are investors, founders, or employees— women get less startup equity than men. Let’s dive into what exactly this looks like.

👩🏽💻 Women as startup employees: seeking just equity

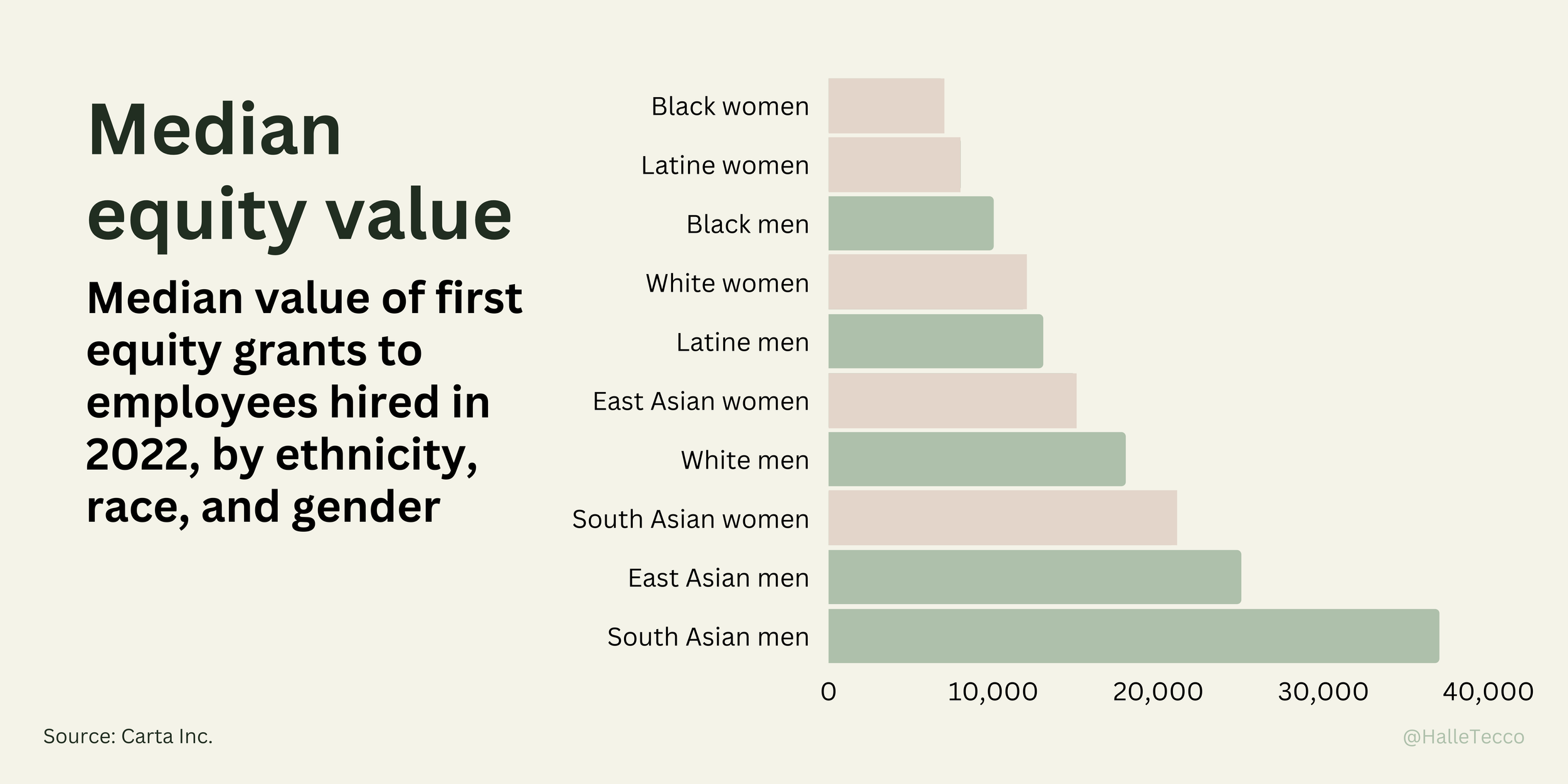

Women make up nearly half of the U.S. labor force, but as employees, we only get only 28% of equity value. This is even worse for Black and Latina women, who get the lowest median value of equity grants.

Even at the very top, where women make up 27% of executive hires, we also receive less equity than men in executive roles. For example, at Series E companies, 29% of executives hired are women but they only get 22% of the executive equity.

This disparity in equity distribution underscores a deep-rooted issue within the startup ecosystem. The underrepresentation of women, particularly Black and Latina women, on cap tables is not simply an anomaly but a reflection of systemic biases that persistently undervalue the contributions of women in the workforce. Even as women ascend the corporate ladder and break into the executive ranks, we continue to grapple with an inequitable distribution of equity. It's not enough to merely increase the number of women in startups; we must also ensure that they are afforded the same opportunities for wealth creation.

👩🏻🔧 Women as founders: fewer deals, fewer dollars, less equity

As founders, women are disadvantaged in a few ways.

Women founders are 63% less likely to successfully raise venture capital financing. All-women teams received just 1.9% of venture capital dollars in 2022, down from 2.4% in 2021. And when women do fundraise, we tend to get fewer dollars and lower valuations, meaning we give up more of the company to investors (who are, of course, more likely to be men).

Even when women start companies with men, we get less equity than our male co-founders.

Yet, we know that women make great founders. According to the Kaufmann Foundation, we have lower median burn rates, greater valuation growth at the early stage, and lower valuation declines at the late stage compared to all-male-founded companies. Women-founded companies also outperform the broader market when it comes to the median time it takes to exit.

😇 Women as angels: did my invite get lost in the mail?

In 2020, angel investment in the United States reached a total of $25B, across 64,480 companies. But when it comes to angel investors, women are underrepresented.

Women still earn less than men – roughly 83 cents to every dollar a man makes (this inequity is even greater for Black and Latine women). This wage discrepancy means that women generally have less cash available to invest. And to qualify as an "accredited investor" – a requirement for many investment opportunities – an individual must have an annual income exceeding $200,000 or a net worth surpassing $1M, thresholds that men are more likely to reach.

And even for women who do have the cash, we’re also up against an existing startup ecosystem with a gender skew. Men comprise the majority of startup founders, and tend to form connections with those in their social networks. This leads to male founders predominantly raising funding from those in their network— male investors. When the Kauffman Foundation looked into why more women aren’t angel investing, one reason was simply that we are not asked to.

When the Kauffman Foundation looked into why more women aren’t angel investing, one reason was simply that we are not asked to.

As a result, cap tables remain stubbornly male-dominated.

👩🏾💼 Women as VCs: a game of venture,

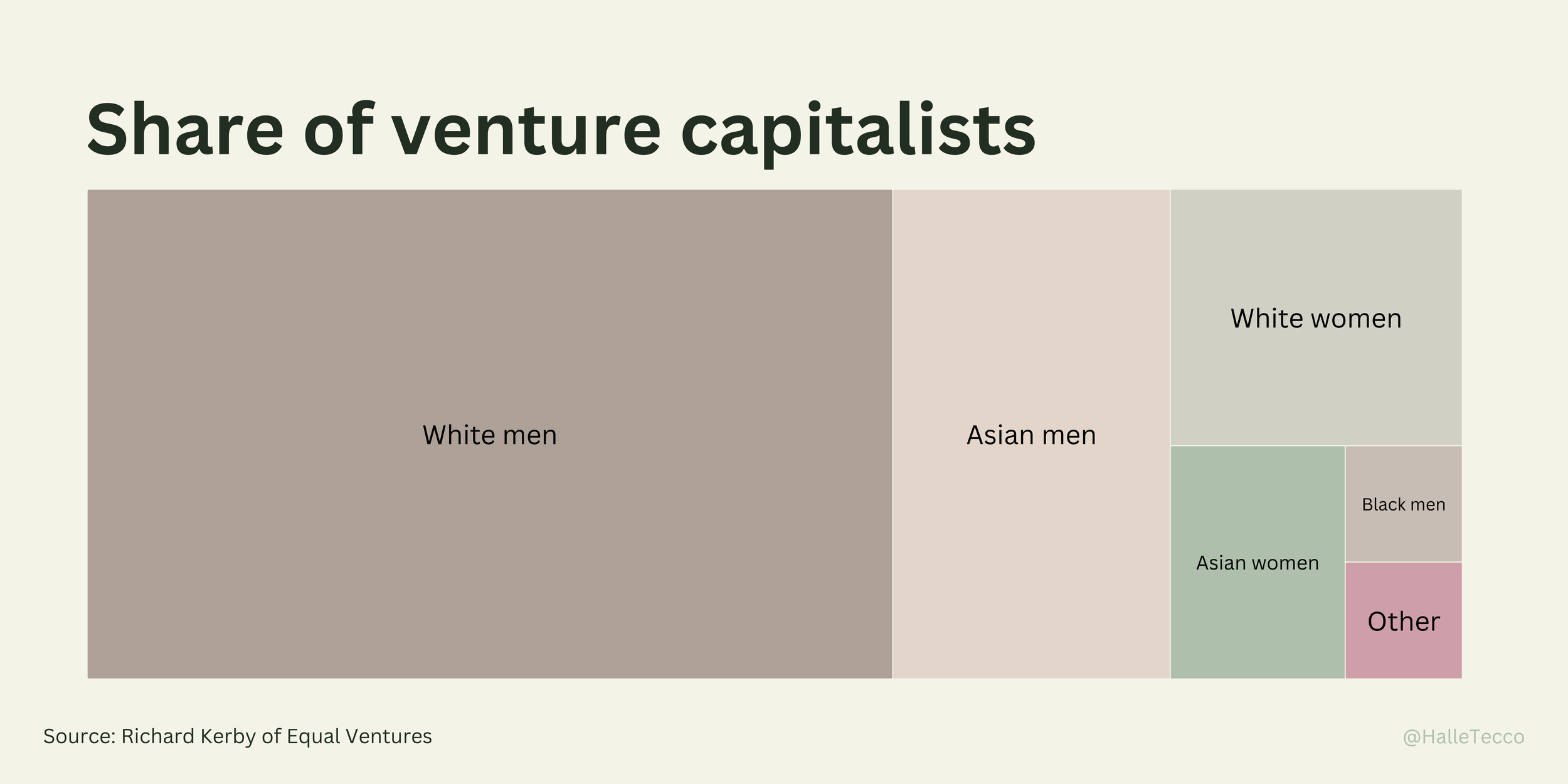

Venture capital remains male-dominated. Only about 13% of VC partners are women. And the majority of VC firms still don’t have a single female partner or GP at their firm.

This is unfortunate, but not surprising. Becoming a partner in a venture capital firm is notoriously challenging and opaque. There are few open partner roles (i.e. only 54 women became VC partners in 2019) and they are seldom advertised or listed on job boards, making them inaccessible to those outside of a tight-knit circle. The traditional path to becoming a partner often involves either raising your own fund, which requires an extensive network and significant resources, or having an inside connection as stated above.

The byproduct of this systemic opacity is that it perpetuates the homogeneity within venture capital firms, inadvertently keeping women and other underrepresented groups at the periphery. The deeply entrenched ‘who you know’ culture in the industry further complicates the diversification of venture capital leadership, posing a formidable hurdle to those who lack the insider connections. The effects of these barriers reverberate beyond the firms, influencing which companies get funded, who ends up on the cap table, and ultimately, how wealth is distributed. Breaking down these barriers is imperative to ensuring that venture capital becomes a more inclusive and equitable field.

The effects of these barriers reverberate beyond the VC firms, influencing which companies get funded, who ends up on the cap table, and ultimately, how wealth is distributed.

The best way to support women in startups: put us on cap tables

Increasing women's representation on cap tables is more than just a statement for gender equity; it's an effective strategy to foster financial empowerment and wealth accumulation among half the population.

There's a pressing need to reconsider the current accredited investor status floor. The Securities and Exchange Commission (SEC) sets specific financial criteria for accredited investor status, including an annual income exceeding $200,000 or a net worth over $1 million. However, given that women typically earn 83 cents for every dollar men earn, these thresholds are more difficult for women to meet, limiting our access to investment opportunities. By rethinking this criteria, we can broaden the investment landscape, allowing more of them to participate in wealth-building through equity investments.

Founders: I encourage you to actively seek out and welcome women and BIPOC angel investors to invest. Lowering the minimum check size can help bring in those that might not have been able to invest larger amounts. Use this as an opportunity to enrich your business with different perspectives and networks. (At Natalist, for example, we purposefully filled our cap table with 21 investors that looked like our customer base: 76% women, 71% people of color, 24% Black women, 81% parents, and 19% LGBTQ+. And then we made an even bigger effort to make them money, which we did.)

As you scale, I encourage you to extend this to your board of directors. Including more women and BIPOC members on your board brings a broader array of experiences and insights, which can only enhance your company's strategic direction and growth potential.

I also encourage you to be thoughtful when offering stock options, with conscientious efforts to eliminate any unconscious bias. Equity compensation, like salary, should be equitable. If the thought of sharing your full cap table with all employees causes discomfort, it's likely an indication of disparities that need to be addressed.

VCs: It's time to be intentional about bringing women into the fold. Invite women and BIPOC angels to participate in deals you're leading. Utilize the influence and networks you've established to open up these opportunities. If you have a scout program, invite us to join. Or better yet, make the recruitment process transparent and include education to help women get up to speed if they’re new to investing.

And of course, if you’re not yet doing so, cast a net wider and actively seek out women-led companies. Take the initiative to break the cycle of funding predominantly male-led ventures. Diversifying your portfolio isn't just a nod to equality, it's a good investment strategy that can lead to better returns.

Enabling more women on cap tables is a powerful lever for wealth redistribution and the creation of a more equitable playing field. And it’s also good for business. Think of inclusivity on cap tables as an opportunity to harness untapped potential for growth and innovation. A more diverse cap table means a more comprehensive understanding of markets, a broader range of ideas, and more robust checks and balances.

The TL;DR on why women are underrepresented on cap tables, and what we can do about it:

Women make up nearly half of the U.S. labor force, but as employees we only get only 28% of equity value

Women founders are 63% less likely to raise venture capital financing, and raised only 1.9% of venture capital dollars in 2022

When women start companies with other women, we get an average of $1M less than men founders

When women start companies with men, we get less equity than our male co-founders

Women make roughly 83 cents to every dollar a man makes, so it’s harder for women to qualify as “accredited investors”

Not only do women have less cash to invest, but those who do have the ability are simply not asked to

Founders: ask more women to be on your cap table (as investors, key employees, and board members), lower your minimum check requirement, and make sure everyone given fair equity

VCs: invite more women investors to participate in deals you’re leading, and actively seek out women led companies

Getting more women on cap tables is a powerful lever for financial empowerment and wealth accumulation for half the population