Angel Investing: Was It Worth It? Part III

Part III: The Unicorns

A startup unicorn refers to a privately held startup that achieves a valuation of over $1 billion. The term "unicorn" was coined by VC (and lead investor in my last startup!) Aileen Lee in 2013 to represent what was at that time a rare achievement.

A business only has a 0.00006% chance of becoming a unicorn, and for those who do become a unicorn, it takes on average seven years from founding to achieve this valuation. For venture-backed startups, the chances are a little better: a venture-backed seed-stage startup has an estimated 2.5% chance of becoming a unicorn.

13.7% of my portfolio companies are currently valued at $1B+ (15.6% if you add Physera which is now part of Omada Health). To compare, 4.5% of the startups that have gone through Y Combinator since 2010 have become unicorns. Who knows what will happen to these companies, but it’s a promising start.

In Part III on my series on angel investing, I’ll share more about the unicorn companies in my portfolio, including:

Details of portfolio unicorns and how I met the founders

Two things these unicorn companies have in common

Markups… and markdowns

Dilution is inevitable

Angels always get squeezed 😭

Growth in valuation vs growth in value

How to protect your ownership as an angel investor

Angel investments that are now valued at $1B+

Below is a current list of the companies that I have invested in that have gone on to become unicorns. Click the arrow to learn a little more about these companies, when I invested, and how I met the founder(s).

Note: All valuations and amount raised shared below are from public sources. Actual valuations may be different. Investor list is non-comprehensive.

-

What they do: Cityblock Health is a transformative, value-based healthcare provider for Medicaid and lower-income Medicare beneficiaries. They partner with community-based organizations and health plans to deliver medical care, behavioral health, and social services virtually, in-home, and in their community-based clinics. Modern technology is at the core of the model, with custom-built tools to support every facet of care team operations and member interactions.

The founders: I met co-founders Dr. Toyin Ajayi, Iyah Romm, and Bay Gross through Bay’s brother Nate Gross, who was a classmate of mine at HBS and my co-founder at Rock Health.

When I invested: 2017 seed round

Current valuation: $6B

Amount raised to date: $592M+ from General Catalyst, Wellington Management, Thrive Capital, Redpoint Ventures, Echo Health Ventures, 8VC, and more

-

What they do: Everly Health is improving the lives of millions with a fully integrated digital care platform for consumers and businesses. They continue to innovate in the space by delivering more care to more people on a seamless diagnostics-driven platform.

The founder: I met the founder, Julia Cheek, at HBS. She was one of the smartest, hardest working people in my section and I would’ve backed any business she started. So I was super excited when she told me she was starting a healthcare company!

When I invested: 2016 seed round

Current valuation: $2.9B+

Amount raised to date: $250M+ from BlackRock, Lux Capital, The Chernin Group, and more

-

What they do: Headway is building a new mental healthcare system that everyone can access. They make it easy for people to find quality in-network mental health care by removing historic barriers faced by mental health providers, payers, and patients.

The founder: I met the founder, Andrew Adams, through a VC friend of mine, Dave Eisenberg. He actually shared their investment memo with me, which was super helpful (I wish more VCs did this for angels).

When I invested: 2018 seed round

Current valuation: $1B+

Amount raised to date: $200M+ from Spark Capital, Thrive Capital, Andreessen Horowitz, Accel, and more

-

What they do: Kindbody is a leading fertility clinic network and family-building benefits provider for employers offering comprehensive virtual and in-person care.

The founder: I met Gina Bartasi at a dinner I was invited to by VC Beth Seidenberg (who was at Kleiner Perkins at the time). Gina and I immediately hit it off and have a shared passion for women’s health. We’re also both IVF moms passionate about improving that journey.

When I invested: 2018 seed round

Current valuation: $1.8B

Amount raised to date: $290M+ from GV, RRE Ventures, Claritas Health Ventures, Morgan Health Ventures, and more

-

I invested in Doctor On Demand, which merged with Grand Rounds to become Included Health.

What they do: Included Health offers cost-savings healthcare solutions for organizations, delivering virtual care & navigation for millions of Americans.

The founder(s): I met Doctor On Demand CEO Adam Jackson through my time at Rock Health. I met the Grand Rounds CEO, Owen Tripp, during this time as well. In fact, Owen was one of the first guest speakers when I started teaching at Columbia Business School in 2016.

When I invested: 2014 seed round

Current valuation: Doctor on Demand joined forces with Grand Rounds in 2021 to acquire and become Included Health. In 2020, Grand Rounds was valued at $1.34B, Doctor On Demand was valued at about $820M, and Included Health was valued at $1.34B. No valuation of the new entity has been shared.

Amount raised to date: $270M from The Carlyle Group, General Atlantic, Venrock, Greylock, BlackRock, and more

-

I invested in Cricket Health, which merged with Fresenius Health Partners and Interwell Health to become Interwell Health.

What they do: Interwell Health is a kidney care management company that partners with physicians on its mission to reimagine healthcare—with the expertise, scale, compassion, and vision to set the standard for the industry and help patients live their best lives.

The founder(s): I met Cricket Health founder Vince Kim when he was a healthcare VC.

When I invested: 2017 seed round

Current valuation: Cricket Health was part of a 3-way merger with InterWell Health and Fresenius Health Partners. The new company is valued at $2.4 billion.

Amount raised to date: Cricket raised $120M from Oak HC/FT, Cigna Ventures, and more

-

I invested in Imperfect Foods, which merged with Misfit Markets.

What they do: They help people get organic produce, high-quality meats, seafood, dairy products, and other sustainably sourced groceries delivered to their door for up to 40% less than grocery store prices.

The founder(s): I met the original Imperfect Foods team through Rebecca Kaden and Anarghya Vardhana at Maveron (Rebecca is now at USV, where I’m now an LP).

When I invested: 2016 seed round

Current valuation: Imperfect Foods and Misfit Markets merged in March of 2023, and the valuation of the new entity is ~$2B+. The combined business is on track to hit $1 billion in sales and reach profitability by early 2024.

Amount raised to date: Imperfect Foods has raised $229M and Misfits Market has raised $526.5M

Two things these unicorn companies have in common

1. They were all part of my existing network

Looking at how I found these investment opportunities, one thing is clear: I didn’t have to go far. Three of the deals were introduced to me by a VC, three founders were industry colleagues, and one team was introduced to me by a business school classmate. I knew all the founders through one degree of separation.

2. They are all healthcare (or health adjacent)

Turns out it helps to invest in a domain you know a lot about. Overall, my healthcare portfolio is more likely to be active with higher valuations, whereas my non-healthcare portfolio is more likely to have gone out of business. I went further into this in Part II.

This seems to be true for most angel investors. A report from the Angel Capital Education Foundation found that investors see higher returns in companies where they have high industry expertise. As angels, we’d like to think this is because we help those companies succeed. In actuality, it’s because we’re better at diligence when we understand the space.

Markups… and markdowns

As I shared in Part I of this series, unrealized returns are gains that are on paper. Until there’s an exit, the company’s valuation, as given by follow-on investors, gives you a decent idea of what your investment may be worth today if you could actually sell your shares (which you usually can’t). As companies grow, the risk of going to 0 decreases. But there is still a tremendous amount of relative risk at the later stages, not to mention dilution of your equity by that point.

Investors often use this markup as an intermediate measure of success since actual returns take so long. As such, markups are really driven by the availability of follow-on capital.

The average markup of the portfolio companies above (not including the merged companies) is 43.5x, and the range is 20x - 55x. That means for every dollar I put in, my shares are currently valued at an average of $43.50 (this is inclusive of dilution- more on that below). This doesn’t mean I can get that money out today like you can with the stock market. And it doesn’t mean I will actually see those returns in the future. There will be markdowns, as a lot of those valuations happened during a market that looks very different from today.

The companies that merged, on the other hand, look a little different. Of the three that merged, only one was technically a unicorn before the merger (although another was very close). The current markup of those three companies is 2.1x. So it looks like mergers aren’t as exciting for early investors as one would hope.

Dilution is inevitable

Just because a startup has a 100x increase in valuation, doesn’t mean your shares are worth 100x more than they were when you invested. Enter: dilution.

Dilution occurs because the total number of shares increases, while your number of shares do not. The denominator gets bigger, and thus your percentage ownership gets smaller.

It is an inevitable aspect of early stage startup investing that happens every time new shares are issued in subsequent funding rounds. In these rounds, new investors inject capital into the company in exchange for equity or an ownership stake. The startup's existing shareholders (early-stage investors, founders, and employees) experience dilution of their ownership percentages.

Keep in mind it’s these same subsequent funding rounds that give startups capital to grow the value of your shares. Without them, it would be hard for startups to move fast and stay competitive.

Angels always get squeezed 😭

In addition to dilution, there’s the impact on different classes of shares, particularly preferred shares vs. common shares. Preferred shares often have certain rights and privileges that provide additional protection to early stage investors. These rights may include a liquidation preference, which grants preferred shareholders priority in receiving proceeds at the sale of the company.

Unfortunately, sometimes your preferred shares are converted to common shares because a subsequent lead investor has decided the deal is only worth it to them if they screw over early shareholders.

Here’s an example of a portfolio company that not only converted angel investor ownership to common stock, but also drastically decreased the number of shares. When things like this happen, it’s usually because the founder has no other choice for financing.

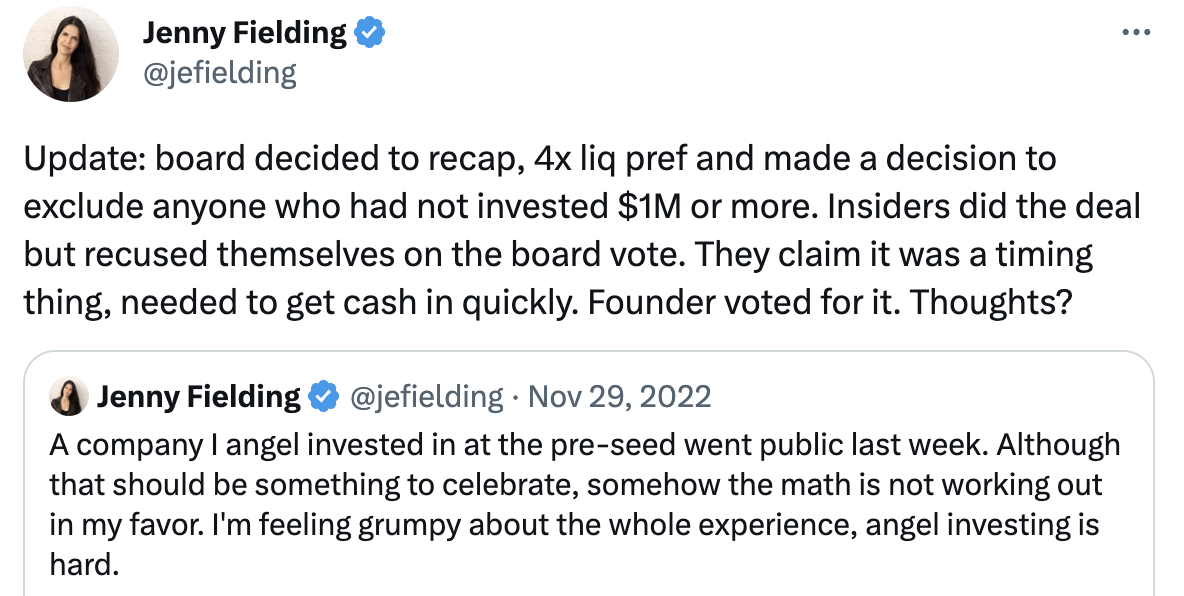

And here’s an example of angel investor Jenny Fielding who was also squeezed out by terms set by later investors. Even though she was first money into a startup that went public, the follow-on investors created subsequent terms that made her investment worthless.

Unfortunately, these scenarios are all too common for early investors.

Growth in valuation vs growth in value

Earlier I said that just because a startup has a 100x increase in valuation, doesn’t mean your shares are worth 100x more than they were when you invested (although I wish it did). Let’s take a look at what this has actually looked like for me.

Here are the portfolio companies with the greatest growth in valuation, and how that multiple compares to the growth in the value of *my* shares.

What’s happening here? Let me explain how this works with a very simple example.

Imagine you bought one share of a company for $10, and there are 10 total shares.

Cost per share = $10

Your ownership = 10% (1 share / 10 total shares)

Value of your shares = $10

Vlue of the company = $100 ($10 per share * 10 shares)

Now, imagine the business is doing really well and a new investor comes along and is willing to pay twice as much per share, so the company creates more shares to sell, and there are now 20 total outstanding shares.

Cost per share = $20

Your ownership = 5% (1 share / 20 total shares)

Value of your shares = $20

Value of the company = $400 ($20 per share * 20 shares)

Notice that the value of the company went up 4x ($100 to $400) but the value of your shares went up 2x ($10 to $20). Now compound this over many, many rounds of financing. This is why the value of your shares won’t increase as much as the value of the startup — but hopefully still leads to a great exit!

How to protect your ownership as an angel investor

One way, in theory, to protect your ownership is with pro-rata rights. A pro-rata side letter is a legal agreement or document that is often used by venture capitalists, and sometimes used by angel investors. Basically, it outlines an investor's right to maintain their ownership percentage in a company by having the right to participate in future funding rounds.

A pro-rata agreement specifies the terms and conditions for the investor's participation, including allocation, timing, and potential preferential treatment. So when a company raises additional capital in subsequent funding rounds, these investors have the right to maintain their ownership percentage by investing in those rounds.

I started asking for pro-rata side letters in 2017. But I recently found out (the hard way) that it’s common for follow-on investors to completely disregard any pro-rata rights of angel investors. Why? That’s equity they want in the company.

I recently had this unfortunate situation with a portfolio company. Upon their most recent financing led by top VCs, I got a docusign from the legal team asking me to waive my pro-rata rights. I asked if I could instead invest to keep my ownership, and they told me the round was full. There’s really no good option for an angel at this point. You can refuse to sign, and annoy the founder and VCs. Or you can sign and willingly give up equity that’s rightfully yours.

When this happens to VCs, the situation is different. First off, I think VCs are less likely to push out other investors than they are individuals. But when it does happen, VCs have the time and resources to assert their rights. As an unpaid angel, with dozens of portfolio companies, fighting every battle is just not feasible.

Read more: