The Many Roles at a Venture Fund — And How to Land Them

It’s ironic that I’m writing this because when I tried to get a job in venture capital (VC) in business school, no one would hire me. At the time, no fund was interested in a dedicated digital health hire, so I started Rock Health. I went from having zero VC experience to co-running a fund, and learning everything along the way.

I think VC is a great job — it’s interesting and intellectually stimulating work, good pay, and you spread your risk across multiple companies. Most importantly, working with and supporting founders feels meaningful. You develop connections with visionaries seeking to change the world, and you get to play a role, however small, in bringing that change to fruition.

But getting a job in VC is not easy. The industry is known for its exclusivity, opacity, and for having a fairly narrow aperture for entry. My own journey into investing—from an angel to an aspiring candidate facing rejection to starting a specialized fund—taught me a few lessons about the VC world.

First and foremost, there's no singular, pre-defined path into this industry. Many get their foot in the door through an eclectic mix of roles, industry experience, and sometimes, as in my case, entrepreneurial initiative.

The lack of a roadmap can be intimidating but also liberating; it opens up opportunities for you to carve your own unique path… Which is helpful because working in venture capital isn't just about deploying capital; it's about deploying yourself—your intellect, your network, your empathy—in service to founders.

So, for those aspiring to join the ranks of venture capital, don't be daunted by the industry's elite facade. Your unconventional background, unique set of skills, or even a past littered with closed doors could be your strongest assets. Sometimes the traditional routes are the most crowded, leaving the road less traveled wide open for those willing to take the risk. After all, venturing into the unknown and betting on potential is what this industry is all about.

So, whether you're a new graduate, an industry veteran, or a career switcher, let's explore the diverse roles within a venture fund—and how you might claim one as your own.

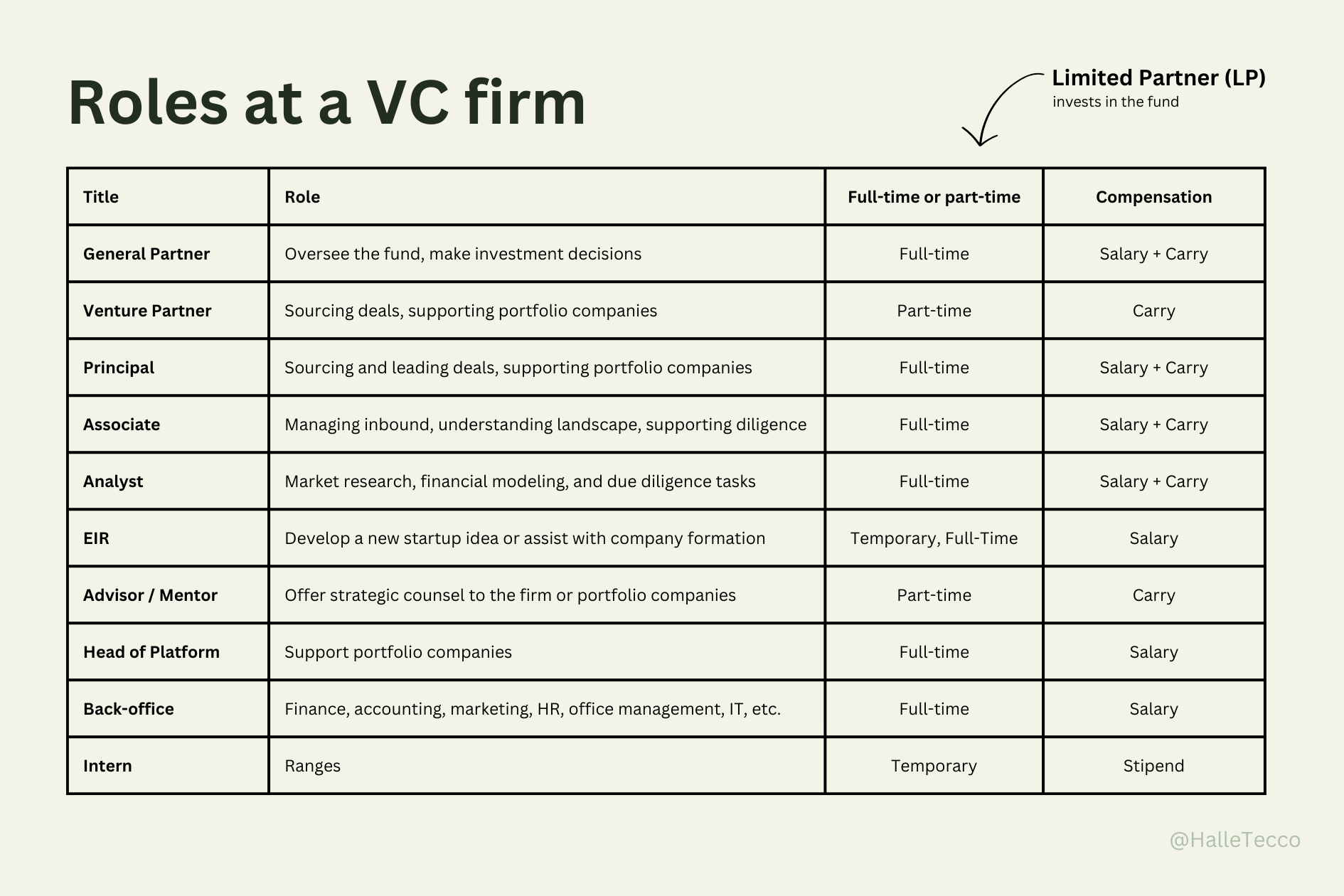

Below I share common titles, responsibilities, and pay scales, but every fund (institutional or corporate) has a different structure.

General Partner (GP)

Arguably the most well-known role within a venture capital firm is the Partner, often broken down into Managing and Non-Managing Partners:

Managing Partners are often the founder(s) of the fund, they control the management company, lead fundraising of the fund itself, and make investment decisions.

Non-Managing Partners (who usually just go by GP) are partners in the fund but may not have control of the management company, but are still senior leaders in the fund.

GPs are the decision-makers, the strategists, and the brand representatives of the fund. They raise the fund, lead investment decisions, cultivate relationships with entrepreneurs, and are typically the ones with the most "skin in the game," both in terms of capital investment and personal reputation.

How much they make:

According to J.Thelander-PitchBook, the median cash compensation for a GP at a fund with under $1B in AUM (assets under management) is $410,000, but this can range based on the size and success of a fund. I know GPs who make over $1M in base salary. The median carry (short for "carried interest," the percentage of a fund's profits that are paid to the fund's managers) for a GP is 25%.

How to get there:

Becoming a partner is often the result of years of experience in the venture capital industry, usually requiring a successful track record as an investor (and a fundraiser!). Many partners also transition from entrepreneurial roles or leadership positions in relevant industries. They either start and raise their own funds or join an existing fund.

Limited Partner (LP)

Limited Partners (LPs) are the external investors who provide the capital that VC firms deploy. They can range from institutional investors like pension funds and university endowments to wealthy individuals and family offices. While LPs are not involved in the day-to-day operations or investment decisions of the fund, their influence can be significant, particularly when it comes to governance and the overall direction of the fund.

How much they make:

Unlike the other roles in a venture capital firm, Limited Partners (LPs) aren't employees but investors. Their financial gain comes not from a salary but from the performance of the fund itself.

LPs pay the GPs a management fee to run the fund, and in return typically get the vast majority (~80%) of the returns when a portfolio company successfully exits (the GPs get the ~20%).

How much an LP makes can vary significantly based on the fund's success. The range can go from losing capital if the investments underperform to earning multiple times the initial investment if the fund has a "home run" exit. According to Industry Ventures, the target IRR (aka internal rate of return taking into account time it takes to make the return) for a fund is 30% for early stage investing and 20% for later stage investing.

How to get there:

Becoming an LP isn't so much a career path as it is an investment decision. If you’re interested in becoming an LP, you’ll need to be an accredited investor, because investing in a venture capital fund is very high risk.

VCs are always raising capital, and the most direct route to becoming an LP is often as straightforward as reaching out and expressing interest.

Venture Partner

Venture Partners differ from General Partners in that they often don’t have a long-term commitment to the fund and may not even be full-time employees. They are specialists brought in for their expertise in a specific domain or industry and are valuable for sourcing deals and advising portfolio companies.

How much they make:

According to Glassdoor, the average base salary for a Venture Partner is $236,052 per year. Keep in mind, Venture Partners are generally not full-time partners. They also get carry in the deals they bring into the fund, and sometimes in the entire fund as well.

How to get there:

Industry experts with a solid network and a proven record in a specific sector may be tapped for Venture Partner roles. Usually Venture Partners have prior entrepreneurial or executive experience.

Operating Partner

Unlike partners who focus solely on deal-making or fund management, Operating Partners engage in the trenches, aiding startups in scaling operations, honing strategy, and sometimes even stepping into interim executive roles.

How much they make:

According to HuntClub, Operating Partners can expect to make $269,000 a year in combined base salary, and many also get carry in the fund.

How to get there:

The journey to becoming an Operating Partner is less prescriptive than that of more traditional venture capital roles. Often, these individuals have already led a successful career in operations or executive leadership, accumulating hands-on experience in scaling businesses. They might hail from the C-suite of a successful startup, with a focus on operational and go-to-market excellence.

Principal (sometimes called Vice President)

Principals usually act as a bridge between associates and partners. They have more authority in the decision-making process than associates but are not yet making the final calls on investments. Their role may include:

Building relationships with entrepreneurs and other investors

Creating investment theses

Overseeing ongoing relationships with portfolio companies

Leading and negotiating deals

Managing relationships with portfolio companies

Principals often lead specific investment theses or sectors within the firm, and usually are on track to either become a partner in 3-5 years or move on.

How much they make:

The median salary for a Principal is $220,000 and the average carry is 3.63% (sometimes on a deal-by-deal basis, and other times in the entire fund).

How to get there:

The journey to Principal often involves first serving as an associate. Demonstrated success in deal sourcing, due diligence, and portfolio management are key progression metrics. In some cases, professionals join as Principals directly from senior operational roles in startups or other industries.

Associate

Associates play a huge role in any venture fund. What they do depends on the firm, but here are some typical tasks an Associate might take on:

Sourcing deals

Screening inbound deals

Maintaining databases of startups

Creating market landscapes and trendspotting

Supporting due diligence and writing investment memos

Supporting portfolio companies

The Associate's role is a mix of analytics and human judgment, often serving as the initial filter through which potential investments must pass.

How much they make:

The median salary for a Senior Associate is $152,500 and the average carry is 1% (sometimes on a deal-by-deal basis, and other times in the entire fund). According to Mergers & Acquisitions, at the large VC firms, Pre-MBA Associates earn $150,000-$200,000 in total comp, while Post-MBA Senior Associates might earn upwards of $250,000.

How to get there:

These jobs are often available both pre- and post-MBA. Having past experience in startups, investment banking, or consulting is helpful. Networking, particularly with current employees and alumni of VC firms, can often open doors to associate roles. But more often than not, these roles are posted online.

Analyst

The analyst role seems less common today than when I was starting out. This is generally a role for new graduates, and their responsibilities often include market research, financial modeling, and due diligence tasks. Analysts are sometimes expected to become experts in specific sectors or technologies, thereby aiding the firm in identifying trends and opportunities before they become apparent to the market at large.

How much they make:

Depending on the firm, I’ve heard of salaries ranging from $75,000 to $125,000. Analysts usually do not get carry in the fund.

How to get there:

To break into this role, candidates typically need a background in finance, economics, or a field related to the firm’s investment thesis (say, computer science or AI). These jobs can be listed online, or you can reach out to firms to express your interest in joining.

Entrepreneur-in-Residence (EIR)

EIRs are entrepreneurs who temporarily join a VC firm to develop a new startup idea or assist with company formation. The role is generally short-term, and they often leave the VC firm to launch their ventures or join one of the firm's portfolio companies.

How much they make:

It’s hard to find data on how much EIRs make, but I’ve heard $150,000 to $250,000 annualized. These roles are generally short-term.

How to get there:

Having a track record as a successful founder and early employee is the standard pathway into an EIR role. EIRs generally have a sense of what they want to work on, but could benefit from some time and support to get it off the ground. Some VC firms also use the EIR position as a way to retain talent between ventures and get in early.

Advisor

Advisors offer strategic counsel to the VC firm or its portfolio companies on a part-time or project basis. Their input can range from providing sector-specific insights to supporting due diligence to bringing in deal flow.

How much they make:

I am an advisor to one fund and get a tiny amount of carry in exchange for my time. I also get to invest in the fund without any management fees.

How to get there:

Typically, senior executives, industry leaders, or even academics serve as Advisors. This role can also be a gateway to more substantial roles within the VC ecosystem, or just a way for them to have insight into innovation in their field.

Mentor

Mentors, although not formally a part of the VC firm, are seasoned entrepreneurs or industry experts who offer guidance to the portfolio companies. These roles are especially common at accelerators and early-stage funds. They help a VC differentiate by offering portfolio companies access to experts in the space.

How much they make:

These are usually unpaid roles, but mentors can get a small amount of carry in a fund.

How to get there:

If you have years of experience and a desire to give back, becoming a mentor can be as straightforward as reaching out to VC firms or startup accelerators and offering your services.

Intern

Internships serve as a gateway to jobs in many venture capital firms. These temporary roles, usually lasting for a few months in the summer (or part-time during the school year), offer a unique vantage point into the day-to-day operations of venture investing. Interns may be tasked with responsibilities ranging from market research and data analysis to supporting due diligence efforts and even assisting in portfolio management.

How much they make:

I’ve seen VC interns make between $25-40/hour with no carry. FOR-PROFIT VENTURE FUNDS WHO DO NOT PAY INTERNS ARE BREAKING THE LAW. Even if the internship is called a “fellowship”, don’t work for free. Not only is it illegal, it’s unethical.

How to get there:

Getting an internship often requires a mix of prior work experience, relevant coursework, and networking. However, VC firms are increasingly valuing diverse skill sets, so don't be discouraged if your background isn't strictly in finance or economics. Many firms appreciate interns who bring unique perspectives, whether from fields like engineering, social sciences, or even the arts.

Other (non-investing) roles

VCs rely on more than just the frontline investors. Especially as a fund grows, there are more operating roles that help a fund run smoothly. Some examples include:

Head of Platform makes sure that portfolio companies have access to all of the resources that a VC firm can provide from knowledge exchange to recruitment to fundraising.

CFO (Chief Financial Officer) is responsible for the financial health and governance of the firm. From managing fund accounting and compliance to overseeing financial strategy.

General Counsel oversees legal activites such as drafting term sheets and managing regulatory compliance.

Back-Office staff can include various roles in accounting, human resources, and office management. They handle tasks ranging from payroll and employee benefits to budget management.

Administrative Assistants are responsible for a myriad of tasks—calendar management, correspondence, and logistical arrangements—that enable the senior leadership to focus on strategic activities.

Investor Relations serves as the bridge between the VC firm and its Limited Partners. They are responsible for communications, performance reporting, and fostering relationships that are critical for capital raising and fund performance.

Other specialized roles can include IT support, data analysts, marketing professionals, and more. As venture capital firms grow in complexity, they may require specialized skills that don't fit neatly into traditional categories but are indispensable for the firm's success.

In terms of career entry points, these roles often require expertise in their respective fields, whether it be finance, law, or communications. The recruiting process may resemble those of other industries but may also demand an understanding of startups or venture capital.

So, if you are drawn to the world of venture capital but feel that investing roles aren't your forte, these non-investing, operating roles offer a meaningful way to contribute. They provide the framework within which the more visible aspects of venture capital—like deal-making and portfolio management—can successfully occur. And for those who excel in these areas, the sky's the limit; your skills are the bedrock upon which great ventures are built.

Venture Capital Glossary

Accredited Investor: An individual or institutional investor who meets specific income, net worth, or professional experience criteria, enabling them to invest in higher-risk, less-regulated investment vehicles like venture capital funds. Accreditation standards in the U.S. are set by the Securities and Exchange Commission (SEC) and you can view the current requirements here.

Advisor: An individual who provides expertise, guidance, and connections to both venture capital firms and their portfolio companies, but is not typically involved in the fund's management.

Analyst: An entry- or junior-level role that focuses on research, data analysis, and preliminary due diligence to inform investment decisions.

Associate: A mid-level role focused on identifying potential investment opportunities, conducting due diligence, and supporting the partners in various functions.

Carry (Carried Interest): The percentage of a fund's profits that are paid to the fund's managers as a performance-based incentive.

Distributions: The profits returned to Limited Partners when a portfolio company is successfully exited.

Distributions to Paid-In (DPI): A performance metric that assesses the ratio of money returned to Limited Partners relative to the capital they initially committed, providing a measure of liquidity and realized gains.

Dry powder: This term describes uninvested capital that a VC firm has yet to deploy. Having sufficient "dry powder" enables the firm to make new investments or follow-on investments in existing portfolio companies.

EIR (Entrepreneur-in-Residence): An entrepreneur or industry expert who temporarily joins a venture capital firm to help identify investment opportunities or develop a new startup idea.

Follow-on investment: This refers to additional investment made by a VC firm in a portfolio company, usually in subsequent funding rounds. Follow-on investments signify a firm's sustained belief in the company's potential.

Fund Vintage Year: The year in which the first influx of investment capital is delivered by investors into a fund. Vintage year is often used to compare the performance of different funds over similar time periods, serving as a valuable benchmarking tool.

Internal Rate of Return (IRR): A metric used to measure the time-adjusted return of a fund.

Limited Partner (LP): An external investor in a venture capital fund, providing the capital that the fund invests but not typically involved in day-to-day operations or investment decisions.

Management Fees: Ongoing fees charged by the venture capital fund to cover operational expenses. Management fees are usually calculated as a percentage of the fund's total committed capital and are typically in the range of 1.5% to 2.5% per year.

Mentor: An experienced individual who offers guidance and advice to portfolio companies to help them grow and overcome challenges.

Multiple on Invested Capital (MOIC): A straightforward metric that calculates the return on a specific investment as a multiple of the original capital invested, offering a snapshot of the investment's performance.

Partner: A senior-level executive in a venture capital firm who is responsible for sourcing investments, making final investment decisions, and managing relationships with portfolio companies.

Principal: Position often found between associate and partner, responsible for sourcing new investments, participating in deal structuring, and supporting portfolio companies.

Term sheet: A non-binding document outlining the terms and conditions under which an investment is made. The term sheet serves as the blueprint for subsequent, legally binding documents.

Total Value to Paid-In (TVPI): A metric that quantifies the total value of a fund (both realized and unrealized gains) relative to how much capital an investor put in.

Venture Partner: An external consultant or advisor who collaborates with a venture capital firm on a part-time basis to source and evaluate potential investments.